Struggling to make ends meet?

Latinos, the Trump tax cuts are ending this year— Congress must act fast to protect your hard-earned money!

Latinos Cannot Afford a Tax Hike

Latino families have worked hard to achieve their goals and build better futures. But some in Washington want to let the 2017 Tax Cuts and Jobs Act (TCJA) expire, raising taxes at a time when the cost of living is already sky-high. Protecting prosperity means safeguarding families and small businesses from higher taxes that threaten progress and make the American Dream even harder to reach.

Congress must act to protect the progress we’ve made—don’t let the Tax Cuts and Jobs Act expire!

TCJA: What You Need To Know

What did the Tax Cut and Jobs Act do?

The TCJA of 2017 lowered taxes for everyone and made filing simpler by cutting out confusing exemptions. This meant more money in your pocket and less going to Washington.

Does the TCJA Work?

Not only does the TCJA work, 80% of Latinos believe that they shouldn’t pay higher taxes and 80% also believe now is not the time to increase taxes. The economic benefits of the TCJA are also undeniable; after the passage of the TCJA real median household income went up by $5,000 and Latinos saw one of the largest periods of wage increase in nearly a generation.

Prior to COVID the United States also saw the addition of 5 million new jobs and more companies began investing here in the US as opposed to outsourcing jobs overseas.

What happens if the TCJA expires?

Skyrocketing inflation fueled by reckless government spending has put a huge strain on family budgets. During the Biden years, prices increased more than 20%, forcing middle-class families to spend $1,000 more a month just to tread water.

If we let the tax cuts expire, middle class Americans would pay an additional $1,500 a year in taxes , leaving them even less money to pay Washington’s higher prices. By keeping the 2017 tax cuts, we can better help hard-working Americans make ends meet.

Protecting Prosperity with a Tax Code That Works for Everyone

Making the Tax Cuts and Jobs Act permanent helps avoid tax hikes, protect jobs, and support the progress of the Hispanic community.

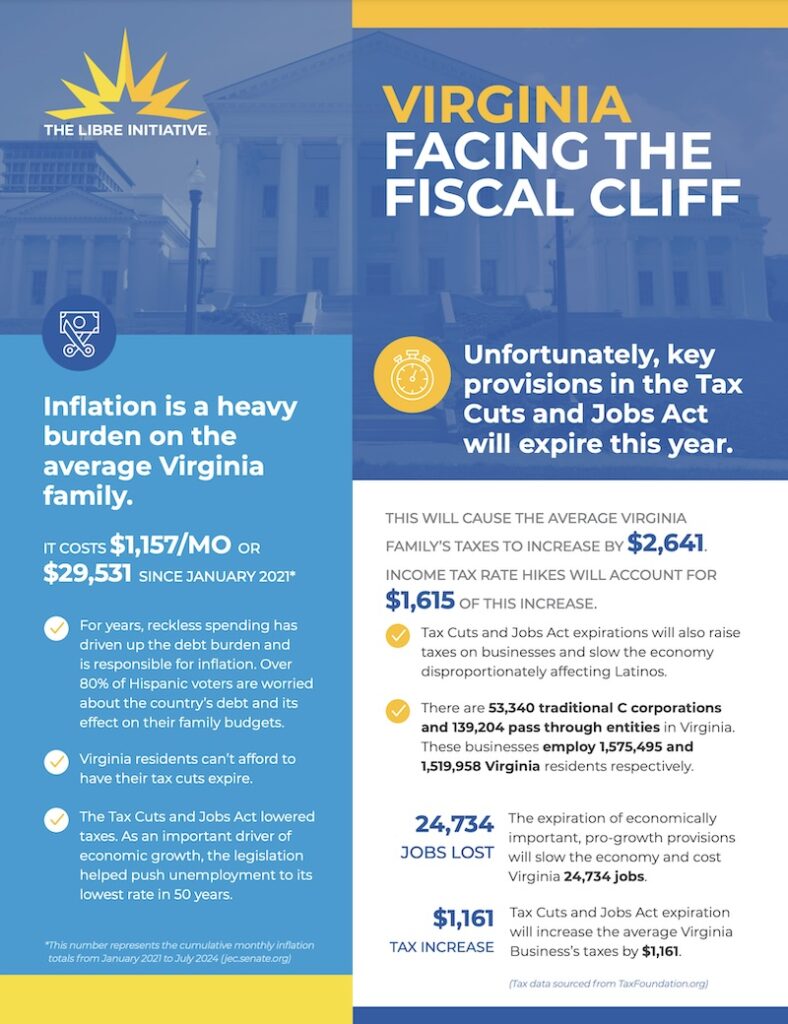

See how your state is facing the fiscal cliff by downloading your states report.

80% of Latinos feel overtaxed:

Tax hikes would take more from already tight budgets, making it harder for families to save, invest, or support loved ones.

92% of Latinos want stable tax rates:

Predictable taxes help families plan for big goals like buying homes or starting businesses. Tax hikes create uncertainty and strain.

1 in 4 new businesses is Latino-owned:

Higher taxes mean less money for Latino entrepreneurs to reinvest, grow, and create jobs in their communities.

72% of Latino businesses face tax hikes if TCJA expires:

Without the current tax cuts, businesses could face higher costs, forcing cutbacks that hurt growth and opportunity.

Select a State

Your voice counts!

Let’s protect our jobs, support Latino businesses, and stop tax hikes. Speak up today to keep opportunity alive in our community!

Your Story Matters

How would a tax hike impact you, your family, or your business? Share your story with us! Your voice can show the real impact on our community and help protect opportunities for all.

-or-

Share this page